David Kostin and team strategists on the market shares of Goldman Sachs argued that in the next 12 months, before the first increase in interest rates the Fed, S & P 500 will grow by 6%.

“Markets do not always follow the historical pattern,” – writes Kostin, “but we expect the S & P 500 gained 6% over the next 12 months, before the long-awaited increase in interest rates the Fed in the third quarter of 2015 shares grew in the years that preceded the first stages of easing, the Fed , in 1994, 1999 and 2004, both microeconomic and macroeconomic indicators suggest that the economy is the United States is strengthening. “

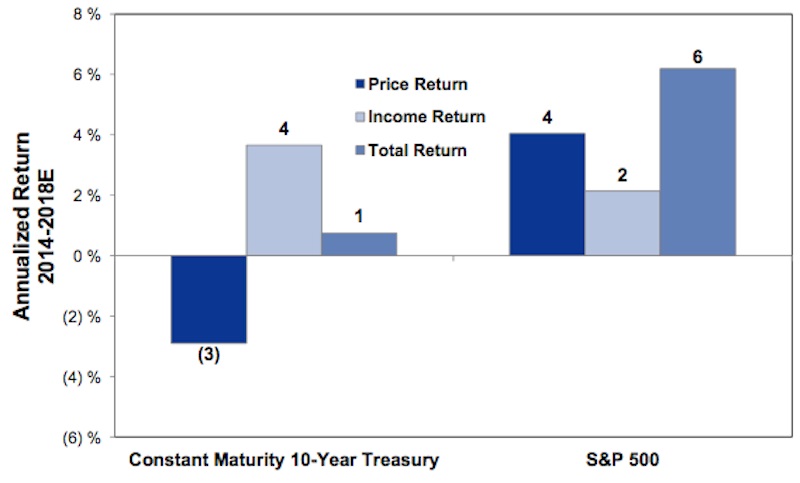

Kostin and his team once again repeated its forecast made earlier this month that “a sharp divergence” expects stocks and bonds in a few years.

Goldman still expects earnings per share until 2018, adjusted for inflation, will be 4% in annual terms, and on bonds – 1%.

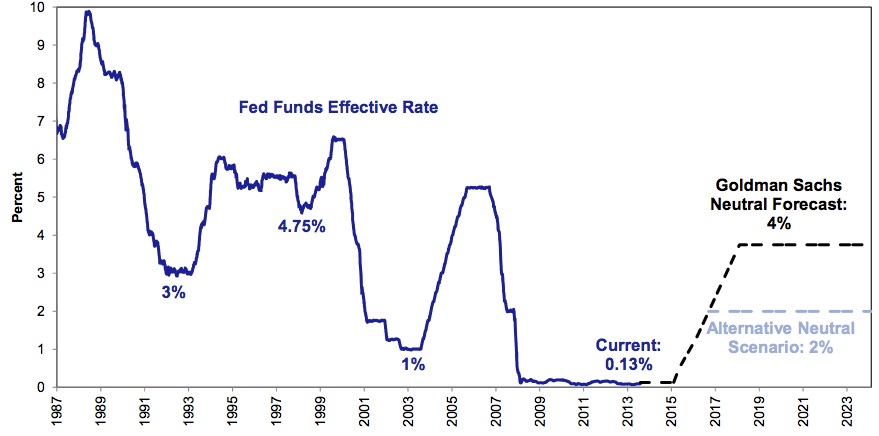

These figures suggest that interest rates will return to normal historical average, 4%.

Goldman Sachs: Stocks do not always follow patterns, but this time it will be so

No comments:

Post a Comment